The Government has announced an extension of two months for filing income tax from the original deadline in consideration of the Movement Restriction Order MRO that has been enforced during the COVID-19 pandemic. Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia.

No guide to income tax will be complete without a list of tax reliefs.

. On the First 5000 Next 15000. Income tax return for partnership. The e-Filing system for submission of Form E for the year of Remuneration 2016 will be opened beginning 1 March 2017.

Grace period is given until 31 October 2017. The deadline to file the 2017 tax return is October 15 2021 if you received an extension. Preparation of tax computation in determining the ExpatriateIndividuals tax positions.

Income tax return for individual with business income income other than employment income Deadline. TaXavvy Issue 4-2017 4 Guideline for submission of tax estimates under Section 107C of the Income Tax Act 1967 The IRB has recently issued the operationalguideline GPHDN 12017 dated 23 February 2017 which explains the procedure for submissionof tax estimates under section 107C of the Income Tax Act 1967 ITA for the following categories of. General issue date is a date when you are expected to receive the tax form.

Particulars required to be specified in the return include the amount of chargeable income and tax payable by the company. 12017 dated 23 February 2017 see Tax Alert No. LAPORKAN PENDAPATAN TAHUN TAKSIRAN 2021 SELEWAT-LEWATNYA PADA 15 MEI 2022 DAN ELAK PENALTI LEWAT KEMUKA BORANG NYATA CUKAI.

30062022 15072022 for e-filing 6. RM 63000 RM 1400 RM 9000 RM 4400 RM 48200. Submission due date is a deadline for your completed income tax return form to reach IRBM.

12 October 2017 DIRECTOR GENERALS PUBLIC RULING Section 138A of the Income Tax Act 1967 ITA provides that the Director General. Aside from having to pay more if youre late to submit your tax form you will get fined if you understated your taxes dont submit a form at all or for various other offences. The Malaysian Inland Revenue Board MIRB has set out a new timetable for certain personal tax filing and employer compliance obligations including due date extensions in light of the COVID-19 crisis.

The due date for submission of the companys ITRF Form e-C for Year of Assessment 2017 is 30 September 2017. Tax Act 1967 ITA 1967 based on the due date for submission of the relevant ITRF. Procedures For Submission Of Real Porperty Gains Tax Form.

You must contact the IRS at 1-800-829-1040 if you filed a. This guide is for assessment year 2017Please visit our updated income tax guide for assessment year 2019. E e-E March 31 2021.

Malaysia Various Tax Deadlines Extended Due. Which is why weve included a full list of income tax relief 2017 Malaysia here for your calculation. The tax return is deemed to be a notice of assessment and is.

Additional 5 increment on the balance of a if payment is not made after 60 days from the final date. Also the MIRB has closed all its office premises until 14 April 2020. The new deadline for filing income tax returns in Malaysia is now 30 June 2020.

Why Have I Not Received My 2017 Tax Refund. The accounting period of a company ends on 28 February 2017. Microsoft Windows 81 service pack terkini Linux atau Macintosh.

Extension of Two Months for Filing Malaysia Income Tax 2020. Lembaga Hasil Dalam Negeri Malaysia HASiL ingin memberikan peringatan kepada semua pembayar cukai yang tidak menjalankan perniagaan agar segera melaporkan pendapatan mereka yang layak dikenakan. The tax filing deadline for person by 30 April in the following year.

As the clock ticks for personal income tax deadline in Malaysia 2018 like gainfully employed Malaysians you may have started visiting the LHDN Malaysia website to do your E-Filing as both a proactive and precautionary measure. A Form E deemed not received is a failure to comply and is an offence under Paragraph 1201b of the Income Tax Act ITA 1967. 62017 Date Of Publication.

While the 28 tax rate for non-residents is a 3 increase from the previous years 25. Resident who does not carry on business. Our personal income tax Form BBEMMT submission package includes.

INLAND REVENUE BOARD OF MALAYSIA TAX ON INCOME OF A NON-RESIDENT PUBLIC ENTERTAINER Public Ruling No. The below reliefs are what you need to subtract from your income to determine your. If you have never filed your taxes before on e-Filing income tax Malaysia 2022.

Once you do you will be asked to sign the submission by providing your identification number and MyTax password. Bayaran Cukai Keuntungan Harta Tanah Available in Malay Language Only. Of course these exemptions mentioned in the example are not the only one.

Malaysia Brands Top Player 2016 2017. 50706 Kuala Lumpur Malaysia Tel. Deadlines for submission of ITRF and payment of Income Tax for Year of Assessment 2016.

03-21731288 Printed in Malaysia by SP-Muda Printing Services Sdn Bhd 906732-M 82 83 Jalan KIP 9 Taman Perindustrian KIP Kepong 52200 Kuala Lumpur Tel. Team arrived in Malaysia on 142017 to participate in a competition organised. On the First 5000.

It may seem intimidating to use e-Filing. E-Filing System Opens on 1 March 2017. Under the self-assessment system companies are required to submit a return of income within seven months from the date of closing of accounts.

30042022 15052022 for e-filing 5. Internet Explorer 110 Microsoft Edge Mozilla Firefox 440 Google Chrome 460 atau Safari 5. The key changes are outlined below.

The new Guidelines are broadly similar to the earlier guidelines and provide clarification on the procedures for the submission of tax estimation forms. For individuals without business income. Dimaklumkan bahawa pembayar cukai yang pertama kali.

Upon conviction employers may be. Income tax return for individual who only received employment income. E - Return form of employer employers which are not companies the deadline is March 31 2017.

The new 45-page Guidelines replace the earlier Operational Guidelines No. Technical or management service fees are only liable to tax if the services are rendered in Malaysia. A much lower figure than you initially though it would be.

Pengesahan ini boleh didapati melalui perkhidmatan ezHASiL di httpsezhasilgovmy atau di cawangan-cawangan LHDNM. The amount of penalty you will have to pay is as per below.

Are There Countries With Multiple Capital Cities Answers Countries In Central America The Hague Netherlands Country

How To Find A Temp Job On A Working Holiday Visa In Australia New Zealand Working Holiday Visa Working Holidays Temp Jobs

Tax Season Is Coming Malaysia Business Income Tax Deadlines For 2022

Canton Fair Phase 3 Takes Place In Guangzhou Return Air Ticket Lkr 61 500 Call Us 0117773300 Travel China Guangzhou Air Tickets Canton Fair Guangzhou

Pin By Uncle Lim On G Newspaper Ads Best Bond Book Cover Investing

Income Tax Malaysia 2018 Mypf My

Thailand Medical Tourism Review Of 2018 Including Up To Date Medical Statistics And Information Relating To Thailand Medical Tourism Tourism Malaysia Tourism

Business Income Tax Malaysia Deadlines For 2021

Tax Season Is Coming Malaysia Business Income Tax Deadlines For 2022

The Real Winners Of The Us China Trade Dispute Business Economy And Finance News From A German Perspective Dw 29 10 2020

Individual Income Tax In Malaysia For Expatriates

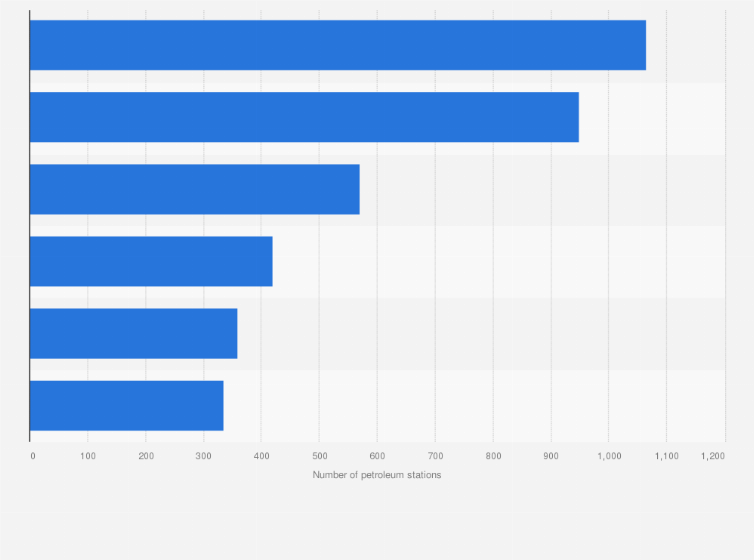

Malaysia Number Of Petroleum Stations By Brand Statista

Income Tax Malaysia 2018 Mypf My

Rates For Regular Gym Memberships At Miracles Fitness At The Garage Ocean View Gym Membership Fitness Membership Garage Gym

Asiapedia Iras 2017 Singapore Personal Income Tax Dezan Shira Associates

Treat Yourself To Tahiti In 2017 2018 Flying Air New Zealand Your Package Includes Return Economy Class 39 Seat Bag 39 Tahiti Air New Zealand Papeete